If you want to implement an effective marketing strategy in China, you must get acquainted with the largest search engines in the country.

As of 2021, China had 1 billion internet users, making it the largest online market in the world. But because of the filters imposed by the Great Firewall of China, a number of well-known search engines, including Google, are not accessible in China.

If Google is not working in China, then what are Chinese people using? Let’s examine the popular Chinese search engines and how they work.

Popular search engines in China

Baidu

The most popular search engine in China is Baidu, and it is comparable to Google in the West. It was among the first search engines to appear in China, and since then, its use has grown significantly.

It dominates the market for search engines in the PRC by more than 75% and even draws some users from abroad, like the United States and Japan.

Baidu only indexes websites using simplified Chinese characters. Therefore, if you don’t have a website in Mandarin, your website won’t appear. Additionally, it favors websites that are stored on Chinese servers.

An Internet Content Provider License is required in order to host a website in China. Let’s learn about the ICP in a later part of the blog. Keep reading!

Also, if you want to know about it in detail, check this blog: Baidu SEO for beginners.

Sogou

Sogou, the second player in China, has been operating since 2004. They managed to gain 24.54% of the market in December 2020, outpacing all other Chinese search engines in terms of growth.

Sogou’s algorithm is unique. As a result, don’t anticipate Baidu SEO strategies to be effective on this search engine. Sogou’s search algorithm highly values original content and site authority. The importance of backlinks as a ranking factor seems to lean more toward quantity than quality.

Due to its more affordable pay-per-click campaigns, Sogou has proven to be very helpful for businesses that aim to market to consumers in lower socioeconomic areas.

With Tencent’s acquisition of Sogou, the Chinese search engine now has a special feature that no other search engine in the country can claim: the ability to search on the WeChat platform. The QQ browser, created by Tencent, also uses Sogou as its default search engine.

Haosou

Haosuo, also known as Qihoo 360 Search and s.com, is ranked third in the domestic Chinese search engine market. The search engine focuses on many services including news, websites, videos, images, music, and many more, and it has a reputation for being safer than Baidu.

Most Chinese computers come with the Qihoo 360 browser preinstalled, making it China’s equivalent of Internet Explorer. Because there is less competition on 360 Search, paid advertisements frequently have a lower cost-per-click.

Haosou is a significant player in B2B marketing because many Chinese companies recommend using it due to its security features. Additionally, rankings seem to reflect this emphasis on cybersecurity, with sites with more authority and credibility appearing to be ranked higher.

Shenma

Shenma is the result of a joint venture between Alibaba and UC Web. One of the most widely used web browsers, UC, uses it as its default search engine. In the upcoming years, it is anticipated that Shenma’s user base will continue to expand.

The fact that Shenma is only compatible with mobile devices is a key characteristic of this Chinese search engine. This is a key factor because of how widely used mobile devices are in China. Shenma is actually widely used for apps, books, and shopping. Shenma is therefore essential if you work in one of these market segments.

Shenma’s link with Alibaba allows it to include direct links to product pages. It’s widely used for home goods, clothing, books, and apps. Products that are listed on Taobao or Tmall (Alibaba shopping properties) are given priority, which improves placement in search results.

Youdao

Chinese search engine Youdao was launched by NetEase in 2007. Websites, images, news, music, blogs, and Chinese to English entries can all be searched using Youdao. Youdao Hui Hui Assistant, a shopping assistant tool that enables users to compare products and prices online, was introduced to Youdao in 2012.

More than 20 languages can be translated from Mandarin by Youdao. It offers example sentences and word usage guidance and is the PRC’s largest translation tool and online dictionary.

Because it includes a free online dictionary, Youdao is very well-liked by Mandarin learners. The Youdao Chinese dictionary is useful because it is simple to use and includes examples of sentences and instructions on how to use words.

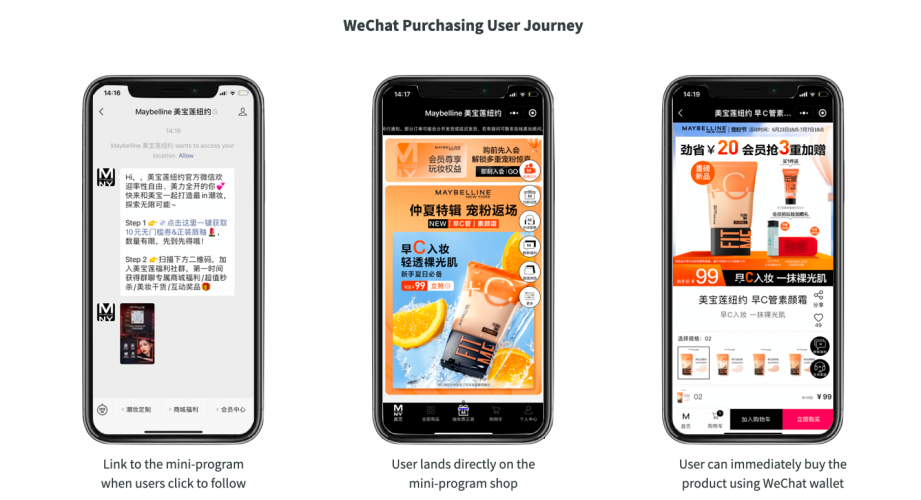

WeChat Search – Souyisou

Last but not least, WeChat’s own search engine is slowly but surely eating its way into the search engine market in China. Launched in 2017, it’s already indexing the majority of content shared by official accounts (as long as published in the text format – read more about do’s and don’ts to optmize your SEO performance in our quick Guide To WeChat Search)

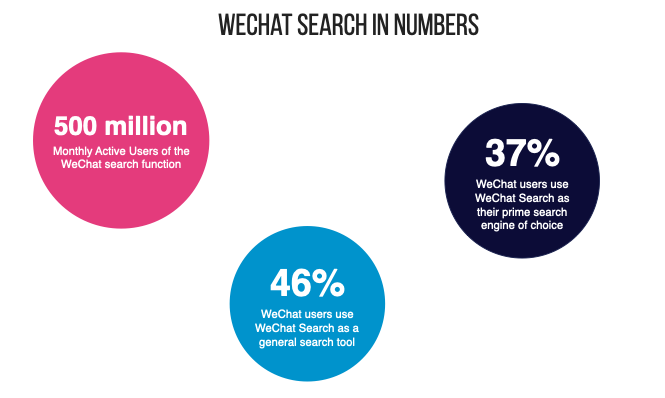

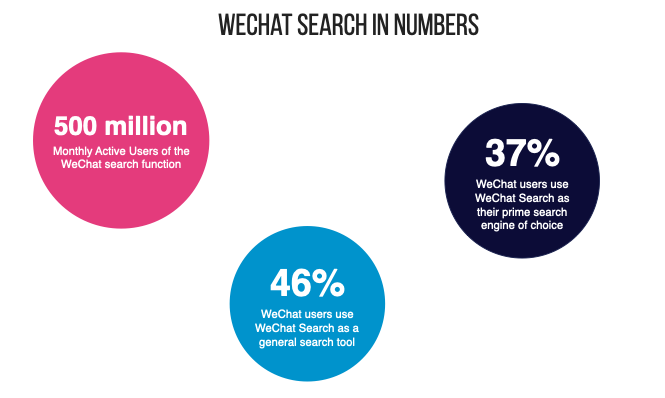

At the moment, its market share is relatively low but with more than 500 million Daily Active Users and Tencent confirming earlier this year at WeChat (Weixin) Class PRO that Seach will be one of the priorities in 2022, we can only expect it will grow considerably in the near future.

SEO in China

People in China will Baidu your brand rather than Google it. Therefore, understanding how Baidu SEO functions is crucial. The main distinctions between the SERPs of Baidu and Google are:

- the interface is available only in Simplified Chinese. No other languages support.

- Links clicked on the SERP open in a new window, keeping the Baidu window always open for users to come back to it.

- Image-based related searches are present for almost every single search on the right side.

- Oftentimes, it is tough to distinguish between organic and paid results

- Google’s mobile search shares the same URL as its desktop version. Baidu uses m.baidu.com for its mobile search engine.

- Google uses structured data from schema.org markup and crawled data for rich snippets, while Baidu provides its own platform (Baidu Open or Baidu Webmaster Tools) for submitting structured data.

- If your site is not mobile-friendly, Baidu might transcode it to make it load faster for mobile devices.

Google vs Baidu’s algorithms

When it comes to algorithms, Google and Baidu’s algorithms are similar in theory, but in practice, Baidu still needs to update its game. Though they are almost similar, they have differences too. Some common differences between Google and Baidu algorithms are

- The algorithm used by Baidu has a significant explicit bias in favor of everything Chinese.

- In terms of Chinese natural language processing, Baidu has a significant edge over Google and typically returns more accurate results for Chinese queries than any other search engine.

- Duplicate content is much less tolerated on Baidu. It may take a long time to regain lost rankings if a website receives a Baidu penalty for duplicate content.

- It’s better to avoid JavaScript and AJAX content if one wants to rank highly in Baidu because the search engine has trouble crawling it.

- Baidu spider typically crawlers Chinese websites much more frequently than those by Google.

- Backlinks from Chinese-based websites are worth much more to Baidu than those from foreign websites.

- In terms of machine learning for image processing, Baidu still lags. Therefore, for an image to rank well in Baidu’s image results, the alt text and surrounding plain text content must be properly optimized.

- Baidu prefers websites with frequently updated content. It affects particularly new websites.

- Compared to Google, Baidu gives a domain age more importance. To rank highly for a new site is harder, but it gets much simpler over time.

- Baidu uses meta keywords as a ranking signal.

What is ICP? Why do you need it?

The Chinese government maintains strict control over the internet. Consequently, obtaining an ICP (Internet Content Publishing License) in China might enhance Baidu’s SEO performance.

A legitimate Chinese hosting company can only host your website on their servers if they have an ICP license. The best way to stay in the competition and stand out is to have a website in China or at the very least use a test to see if your website is blocked due to the Great Firewall in China and an increasing number of blocked foreign websites.

Compared to websites without an ICP license, obtaining one means much faster loading times for internet users. Internet users in China are therefore more likely to discover websites with an ICP license and to visit those sites again. Possessing an ICP license enhances Baidu SEO results. The ICP license, however, is restricted to businesses with Chinese registrations. Even though Baidu will not block websites for not having an ICP license, having one is not absolutely necessary for Baidu SEO. Paid media on Baidu it’s another story.

Conclusion

Although Baidu is the most popular search engine in China, it does not have market dominance. Users can use a wide range of additional resources, as we have already discussed in this article.

It is essential to familiarize yourself with the different search engines before creating a strategy for the Chinese market in order to ascertain which search engines resonate with your audience and how to use them to gain the most exposure.

If you wish to know more about Chinese search engines and SEO strategies or other marketing techniques in China, please contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their networks among Chinese customers. For additional information, please contact us at contact@thewechatagency.com.