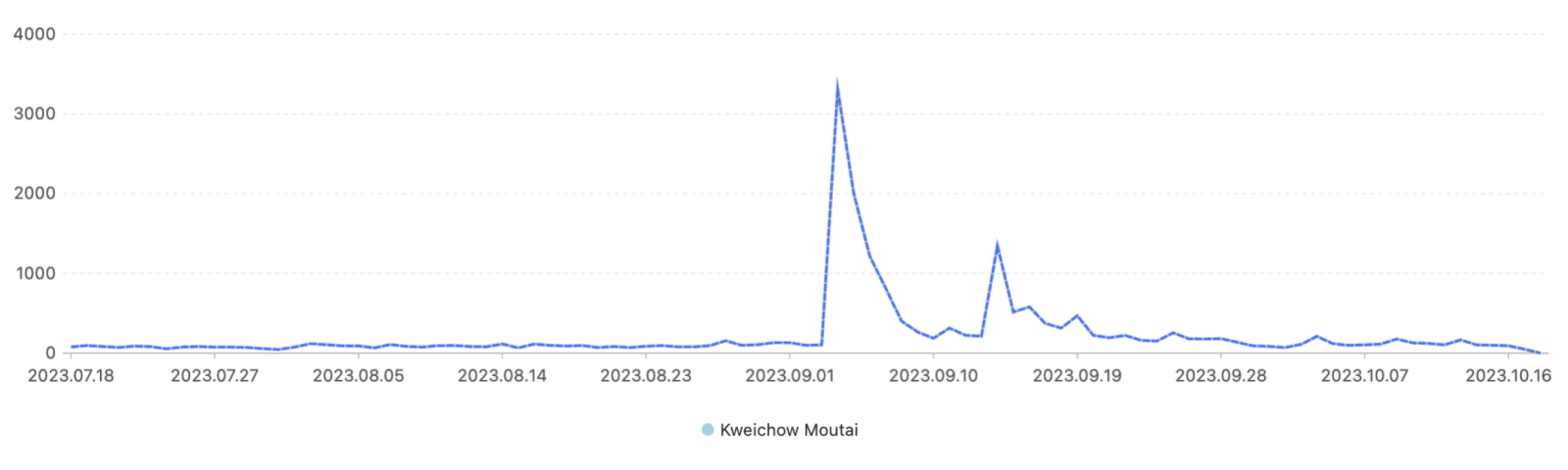

Understanding Xiaohongshu’s dual-track content distribution—discovery and search—is crucial for any brand looking to optimize its keyword strategy. On the “Discovery” page, the algorithm matches content quality with user interests, casting a wide net for potential reach. Meanwhile, the “Search” page is where users enter specific keywords—direct signals of intent—allowing for precise targeting.

These two ecosystems are closely linked. If your note achieves high click-through rates from search, Xiaohongshu’s system will then recommend it to more similar users, creating a “search exposure → interaction → discovery recommendation” flywheel effect. This explains why a post with little initial traction can suddenly explode months later: as your keyword strategy steadily surfaces content to new audiences, accumulating clicks will eventually trigger the algorithm’s next-level recommendations.

Many brands rely solely on brand, category, or pain-point keywords—but this isn’t enough. Effective keyword planning starts with understanding the user’s decision process.Below, we break down the six must-use keyword categories every brand should incorporate into their Xiaohongshu strategy with actionable content tips for each.

1. Category Keywords – Sparking Initial Interest

These are broad terms like “electric toothbrush” or “hydrating essence.” Users searching these are just beginning to explore a solution.

Content Tip: Create product comparison guides, “how to choose” lists, and expert overviews to position your brand as an authority from the start.

2. Pain-Point Keywords – Targeting Strong Motivation

Keywords such as “yellow teeth,” “blackheads,” or “cakey foundation” reveal urgent, specific problems.

Content Tip: Use before-and-after tutorials, real-user stories, or quick-fix hacks that put the problem and your product’s solution front and center.

3. Scenario Keywords – Contextualizing Your Value

Searches like “travel-friendly,” “workout-proof makeup,” or “summer skincare” show users are thinking about practical usage scenarios.

Content Tip: Highlight your product in situational lists (“Best gym bag essentials,” “Must-haves for business travel”), matching benefits to real-life moments.

4. Competitor Keywords – Winning the Final Decision

Terms like “Usmile vs. Philips” or “best foundation for oily skin” indicate a user is comparing options and ready to buy.

Content Tip: Publish side-by-side comparison tables, influencer “battle” reviews, or test results that clearly show your strengths over competitors.

5. Demographic Keywords – Precision Targeting by User Group

Tags like “student budget skincare,” “sensitive skin routine,” or “petite fashion finds” let you target niche audiences in a crowded market.

Content Tip: Develop campaigns for specific groups (e.g., “Dorm room beauty hacks for students”) using relatable settings and tailored product combos.

6. Long-Tail Keywords – Unlocking Niche Demand

These hyper-specific phrases (“orthodontic toothbrush for teens,” “pregnancy-safe face masks”) may have lower search volume, but much higher conversion rates.

Content Tip: Create deep-dive content for each long-tail keyword—listicles, guides, or solution stories—to capture these motivated, under-served segments.

Want help optimizing your Xiaohongshu keyword strategy? Contact us for tailored, expert support that drives results.