China is now home to over 1.3 million high-net-worth individuals (HNWIs), representing one of the most influential and high-spending consumer segments globally. As we move through 2025, brands looking to capture the attention of this affluent group must understand their evolving lifestyle preferences, media habits, and consumption behaviors. Here are key insights and strategies to help brands effectively engage Chinese HNWIs.

Lifestyle Trends: Beyond Material Wealth

While financial success has brought Chinese HNWIs confidence and freedom of choice, it has not eliminated their desire for a more emotionally fulfilling life. Increasingly, they seek a balance between professional achievements and family or personal well-being.

This shift is driving demand for:

- Family-oriented experiences

- Personal development and self-care

- Curated leisure activities that promote emotional connection

What This Means for Brands:

Luxury brands must move beyond material appeal and deliver emotionally resonant experiences that prioritize well-being, human connection, and exclusivity.

Investment Behavior: Value and Security Come First

In an uncertain economic climate, Chinese HNWIs are embracing a more conservative investment mindset. Their current priorities include:

- Wealth preservation

- Long-term, stable returns

- Safe investment options like gold

What This Means for Brands:

Promote products and services that emphasize sustainability, longevity, and financial security. Messaging should appeal to their desire for stability and trustworthiness.

Consumption Behavior

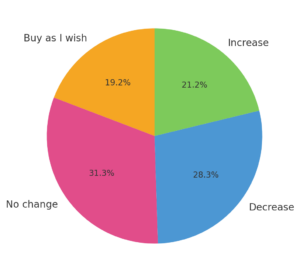

Luxury Goods

- 50% of HNWIs continue to purchase luxury items regardless of economic changes.

- They value brand heritage, craftsmanship, and uniqueness.

- Self-pleasure, subtlety, and personal style matter more than logos.

Beauty Products

- HNWIs prefer high-performance, premium international skincare.

- Makeup buying is trend-driven and intuitive.

- Perfume is a form of self-expression; niche, exclusive scents are preferred.

Experiences

- Interest in exclusive events, parent-child activities, and outdoor experiences is growing.

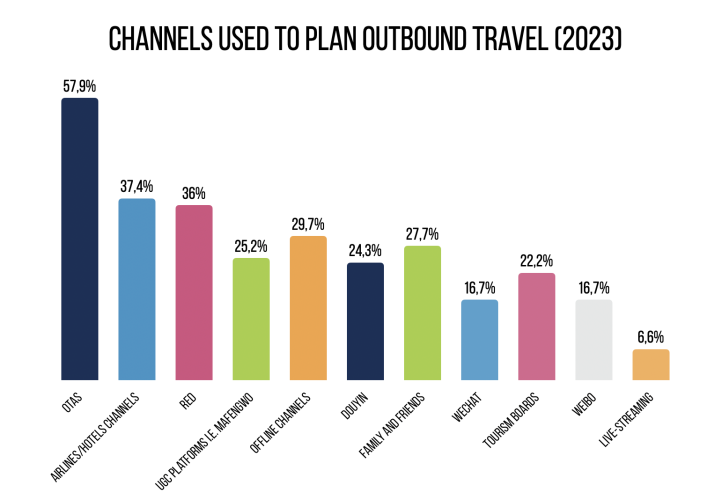

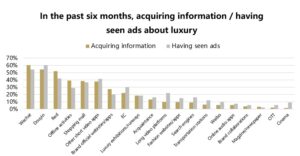

Media Habits: WeChat Remains the Center of Digital Life

WeChat is the most trusted and widely used digital platform among HNWIs in China. It provides a private, controlled environment where brands can foster deeper engagement through:

- Official accounts

- Mini-programs

- Private groups (WeChat private domain)

In addition to digital platforms, HNWIs place high trust in advertisements in premium offline locations, particularly airports, due to their association with high status and exclusivity.

What This Means for Brands:

A robust WeChat strategy is essential. Combine subtle, personalized communications with high-status placements both online and offline.

Marketing Strategies to Reach Chinese HNWIs

To successfully engage this elite audience in 2025, brands should focus on:

1. Personalized & Exclusive Experiences

Offer one-on-one services, VIP access, and bespoke events to meet the need for exclusivity and emotional connection.

2. Security-Focused Messaging

Emphasize product reliability, financial value, and brand heritage to resonate with cautious, value-driven consumers.

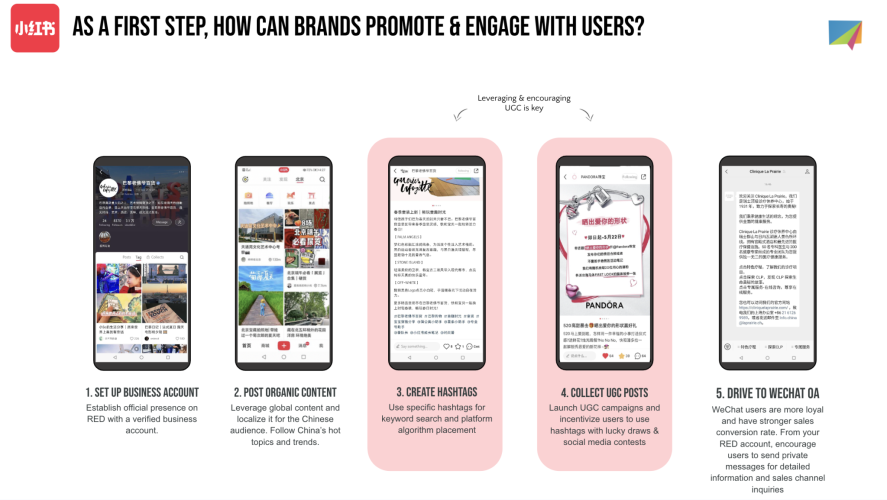

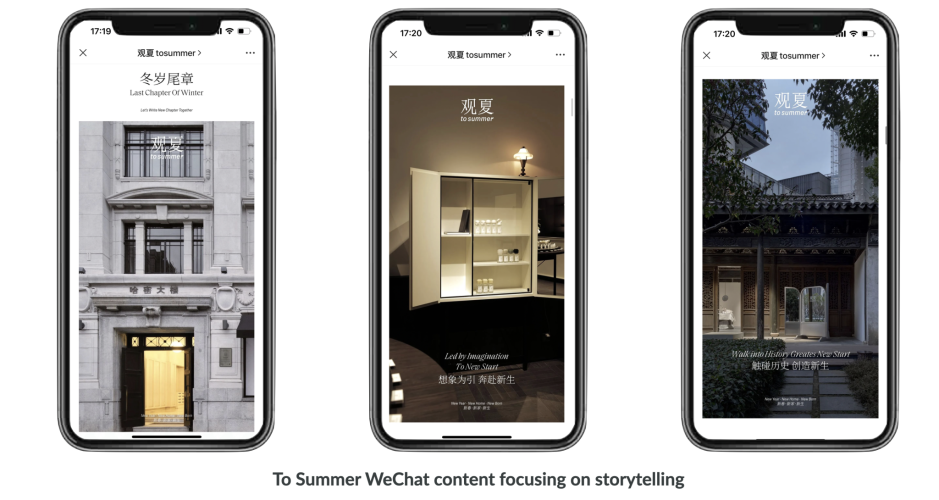

3. Private Domain Marketing via WeChat

Leverage mini-programs and official accounts to provide tailored content, loyalty programs, and discreet communication.

4. Elegant and Subtle Digital Campaigns

Avoid aggressive sales tactics. Instead, use minimalist visuals, sophisticated storytelling, and value-led content.

5. Presence at Exclusive Events

Participate in or sponsor high-profile events such as luxury expos, automotive showcases, and curated cultural experiences.

Ready to Connect with China’s Elite?

If your brand is looking to create targeted campaigns that resonate with Chinese HNWIs, our team can help. Contact us today to develop a custom marketing strategy that aligns with their values, habits, and aspirations.