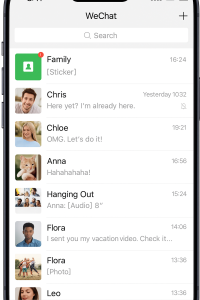

If you are traveling to China or doing business with Chinese companies, downloading WeChat—a “super-app” with over 1.3 billion users essential for daily life—is practically non-negotiable. However, its massive scale raises serious concerns for international users regarding data privacy, government surveillance, and personal security. For travelers, expats, and global businesses, the core question remains: is WeChat safe? This guide explores the reality of WeChat’s security architecture, examining data risks and censorship while providing practical steps to protect yourself.

What Is WeChat and Why Is It So Widely Used?

From Messaging App to Super-App Ecosystem

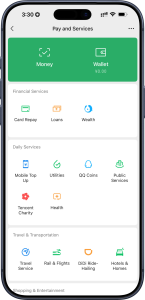

To understand the risks, you must first understand the scope of the platform. WeChat, developed by Tencent, has evolved far beyond simple text messaging. It is a comprehensive ecosystem that integrates social media, e-commerce, mobile payments, and millions of third-party “mini-programs” into a single interface.

This concept is often referred to as a “super-app”. In China, it effectively replaces Uber, Facebook, Tinder, Apple Pay, and GrubHub combined. For individuals and businesses operating in the region, it is indispensable; there is often no functional alternative for digital payments or basic communication.

Global Adoption and International Use Cases

While its primary user base is in China, WeChat’s influence extends globally. It is a critical tool for the Chinese diaspora to stay connected with family back home. Furthermore, it has become essential for cross-border business communication, serving as the primary bridge for international companies trying to reach Chinese consumers or suppliers.

How Does WeChat Handle User Data and Privacy?

Data Collection and Storage Practices

WeChat collects an immense amount of user data. This includes standard information like messages and contacts, but also extends to precise location history, device data, and usage patterns across its millions of integrated services.

A major point of contention is where this data is stored. Most data is housed on Tencent’s servers, and recent regulations have blurred the lines regarding cross-border data transfer. While there are distinctions between “WeChat” (international) and “Weixin” (domestic) accounts, the infrastructure often overlaps, raising questions about whether international user data is truly segregated.

Government Access, Surveillance, and Legal Framework

The most significant privacy concern stems from the legal environment in which Tencent operates. Under China’s Cybersecurity Law, National Intelligence Law, and the Personal Information Protection Law (PIPL), tech companies are legally obligated to cooperate with government authorities if requested.

This creates a complex jurisdictional challenge. While strict data privacy laws like the GDPR protect users in Europe, the overarching requirements of Chinese national security laws can theoretically supersede these protections when data touches Chinese servers.

Transparency and User Consent Limitations

Critics often point to the opacity of WeChat’s privacy policies. While users must consent to terms of service, the scope of permissions granted is vast and often non-negotiable if one wants to use the app’s full functionality. Various research findings have suggested that monitoring and censorship capabilities are built directly into the platform, affecting how data is processed even before it leaves the user’s device.

What Are the Main Security Vulnerabilities of WeChat?

Message Security and Lack of End-to-End Encryption

Unlike Western competitors such as WhatsApp or Signal, WeChat does not offer end-to-end encryption (E2EE) by default. This means that Tencent has the technical key to decrypt and read messages stored on its servers.

For casual users, this may not be an issue. However, for those conducting sensitive communications—whether journalists, activists, or corporate executives—this represents a significant security gap. In comparison, platforms like Signal and Telegram (in secret chats) prevent even the service provider from accessing message content.

Third-Party Integrations and Mini-Program Risks

The convenience of “mini-programs”—apps within the app—introduces another layer of risk. When you use these services to order food or shop, you are often required to share data with third-party developers. This data sharing reduces user control and expands the attack surface for potential leaks, particularly regarding financial and health-related data.

Account Hacking and Reported Security Incidents

Like any major platform, WeChat is a target for cybercriminals. There have been numerous examples of account hijacking and credential theft. Publicized incidents, such as the NinjaDefender reports in 2024, highlight vulnerabilities that attackers can exploit. Consequently, maintaining robust account-level security practices is essential to prevent unauthorized access.

Censorship, Compliance, and Regulatory Challenges

Content Moderation and Censorship Mechanisms

WeChat employs a sophisticated system of automated and manual filtering to police content. This system scans for sensitive keywords and images related to politically sensitive topics.

If a user triggers these filters, consequences can range from simple message blocking—where the sender sees the message as sent, but the receiver never gets it—to “shadowbanning” or total content suppression. Crucially, research indicates that these censorship mechanisms can impact users both inside and outside China, as international accounts communicating with domestic users are still subject to scrutiny.

Compliance Risks for International Businesses

For international businesses, this creates a compliance minefield. There is a direct conflict between adhering to Chinese censorship requirements and meeting international privacy standards. Companies in regulated industries, such as finance or law, face particular risks when employees use WeChat for official business, necessitating strict internal compliance policies.

How to Protect Your Privacy and Security on WeChat

Security Best Practices for Individual Users

If you must use WeChat, you can take steps to harden your account. First, meticulously review your privacy settings and restrict permission management for the app and its mini-programs. Enabling two-factor authentication and practicing good password hygiene are critical baselines. Most importantly, avoid sharing highly sensitive personal information or trade secrets over the platform.

Recommendations for Businesses and Organizations

For organizations, allowing employees to use personal WeChat accounts for work is risky. A better alternative is WeChat Work (WeCom), the enterprise version of the app. While it offers better administrative controls, it still has limitations regarding data privacy. Companies should implement strict policies regarding data retention and employee training to ensure staff understand what should and should not be discussed on the platform.

Alternatives to WeChat for Privacy-Conscious Users

For those prioritizing privacy, relying solely on WeChat is not advisable. Encrypted messaging alternatives like Signal, Telegram, or WhatsApp remain the gold standard for secure communication.

However, these platforms face functional and geographic limitations in China, often requiring a VPN to access. The most effective strategy for travelers and expats is often a “hybrid approach”: use WeChat for payments and daily logistics where necessary, but move sensitive conversations to a secure, encrypted app immediately.

Is WeChat Safe to Use? Key Takeaways

Ultimately, the decision to use WeChat involves balancing necessity against privacy trade-offs. For travelers and expatriates living in China, the app is practically unavoidable. For businesses, it is a vital marketing and communication channel. However, the risk level remains high regarding data surveillance and lack of encryption. The safest approach is to treat WeChat as a public space: assume everything you do and say is visible, and limit your exposure accordingly.

Frequently Asked Questions About WeChat Safety

Is it safe to download WeChat?

Downloading the app itself is generally safe from official app stores. The risks are related to data privacy and surveillance rather than malware.

Can WeChat access my phone data?

Yes, WeChat requests extensive permissions, including access to contacts, location, camera, and microphone, which it uses for its various features.

Is WeChat safe for foreigners?

Foreigners are subject to fewer restrictions than domestic users, but their data is still subject to Tencent’s policies and potential government access.

Is WeChat safe in the US or Europe?

Using WeChat in the US or Europe is legal, but users should remain aware that their data may still be processed in servers accessible to Chinese authorities.

Can messages be monitored or censored?

Yes. WeChat does not have end-to-end encryption, and messages are subject to automated scanning and censorship, particularly for political content.

What to do if an account is hacked?

Immediately freeze your account through the WeChat Security Center, change your password, and unlink any connected bank cards.

Are WeChat Pay transactions secure?

WeChat Pay is generally considered secure for transactions, using encryption and password protections, but it links your real-world identity to your digital activity.

Is WeChat safer on the iPhone?

iOS generally offers more granular control over app permissions than Android, which can help limit the data WeChat accesses, but it does not change the app’s internal data policies.

What are the main business risks?

The primary risks include theft of intellectual property, lack of data privacy compliance, and the inability to control internal communication records