As the B2B marketing landscape in China rapidly evolves, staying ahead means understanding where your audience spends their time—and increasingly, that place is Douyin. Once considered primarily a B2C platform, Douyin is now gaining significant traction among B2B marketers looking to connect with China’s next generation of decision-makers.

Why Douyin Is Emerging as a B2B Marketing Powerhouse

With 743 million Monthly Active Users (MAUs) and strong penetration in Tier 1 and Tier 2 cities, Douyin has become the third most-used social media platform by multinational corporations in China, after WeChat and WeChat Channels.

So, what’s fueling this growth?

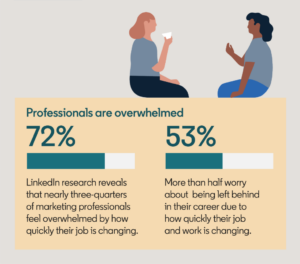

- Changing Buyer Behavior: Millennials—now key B2B decision-makers—prefer self-guided research over sales calls. They seek engaging, short-form content to inform purchasing decisions.

- Smart Recommendation Algorithms: Douyin’s algorithm ensures that your content reaches the most relevant users, increasing targeting efficiency and lead quality.

- Immense Reach: The platform’s scale and format offer unprecedented brand visibility, especially at the top of the funnel.

Key Benefits of Using Douyin for B2B Marketing

1. Massive Brand Exposure

Your brand can reach millions of professionals—many of whom are actively involved in procurement and decision-making.

2. Highly Engaging Content Format

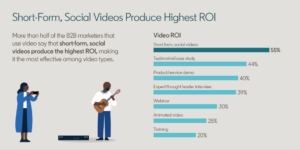

Douyin’s short-form video format is perfect for showcasing product use cases, customer success stories, or industry trends in a digestible, entertaining way.

3. Two-Way Engagement

Comment sections and DMs allow for direct interaction with prospects—something not easily achieved through traditional B2B channels.

How to Do B2B Marketing Effectively on Douyin

Create Short, Impactful Videos

Focus on content like:

- Product demos

- Thought leadership insights

- Case studies

- Behind-the-scenes of your company or product

Tell a Compelling Brand Story

Users connect with stories, not sales pitches. Humanize your brand with:

- Founder stories

- Team introductions

- “A day in the life” at your company

Embrace Creative Formats

Douyin rewards creative content. Try:

- Animation and explainer videos

- Light-hearted skits or scenarios

- Interactive Q&As or challenges

Best Practices for Douyin B2B Campaigns

- High-Quality Production: Use professional visuals, crisp audio, and seamless editing to capture attention.

- Active Engagement: Respond to user comments and messages promptly to build relationships.

- Timely Content: Align content with trending topics, industry news, or product launches to stay relevant.

Case Study: JLL’s Douyin Strategy

Global real estate leader JLL used Douyin to build professional video profiles for their consultants. The result? More human, relatable connections with potential clients—boosting both individual engagement and overall brand perception.

Ready to Leverage Douyin for Your B2B Growth in China?

If your brand wants to tap into a fast-growing, digitally savvy B2B audience in China, Douyin is a powerful tool worth investing in. Contact us today to build a tailored Douyin strategy that drives awareness, engagement, and long-term value for your business.