As 2025 unfolds, brands are redefining their marketing strategies to align with evolving consumer behaviors and cultural shifts. From leveraging seasonal changes to embracing emotional marketing, the key to success lies in crafting authentic connections with audiences. Here are six emerging trends that will shape marketing strategies in the coming year:

1. Four Seasons, New Ideas: A Year-Round Opportunity for Product Launches

Seasonality is no longer just about holiday marketing. Brands are increasingly tying product releases to the emotions and experiences associated with each season, creating year-round engagement opportunities. Whether it’s fresh spring launches, summer exclusives, cozy fall collections, or winter holiday specials, brands can use these shifts to capture attention and boost sales.

Actionable Tip: Develop seasonal content that showcases your product’s unique features in the context of changing seasons. Limited-time products and collaborations can add urgency and excitement to your campaigns.

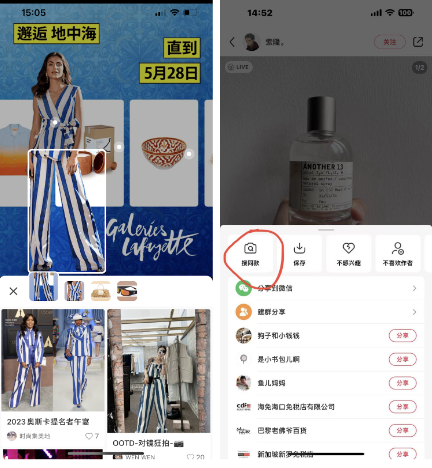

2. Gifting and Co-Branding: The Power of Collaborations

The art of gifting is being redefined by strategic collaborations. Brands are teaming up with influencers, artists, and even other brands to create exclusive, co-branded gift collections. These limited-edition partnerships generate buzz and drive consumer interest, especially during peak gifting seasons.

Actionable Tip: Seek partnerships that complement your brand’s identity. Collaborating on special edition products or campaigns can increase brand visibility and attract new customers.

3. Opening “Her” Narrative: Empowering Women through Storytelling

Brands are moving toward more inclusive storytelling, particularly in narratives centered around women’s empowerment. From body positivity campaigns to mental health advocacy, brands that authentically champion women’s causes can foster deeper connections with their audience. International Women’s Day 2025 will be a key moment to highlight such commitments.

Actionable Tip: Align your brand’s storytelling with genuine causes that matter to your audience. Ensure that your marketing efforts around women-centric themes are authentic, inclusive, and impactful.

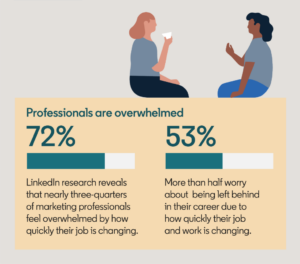

4. Young People’s Mental Wellness: A Focus on Emotional Marketing

Mental wellness is becoming a core focus for brands targeting younger audiences. With increased stress levels among Gen Z and Millennials, companies are integrating mental wellness themes into their marketing strategies. Campaigns that promote self-care, mindfulness, and stress relief resonate deeply with young consumers.

Actionable Tip: Create content that supports emotional well-being, such as stress-relief tips or self-care routines. Engaging with this trend can strengthen your brand’s emotional connection with consumers.

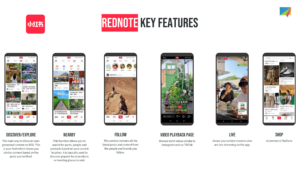

5. “New Chinese Style” Festivals: Blending Tradition with Modernity

Chinese cultural festivals like Chinese New Year and Mid-Autumn Festival remain pivotal marketing moments. However, the trend of “New Chinese Style” is emerging, where brands merge traditional elements with contemporary aesthetics. This approach allows brands to engage younger consumers while celebrating cultural heritage in a modern way.

Actionable Tip: Incorporate traditional symbols and local artistry into your holiday campaigns, but present them through a modern, visually appealing lens. Collaborate with local creators to enhance authenticity.

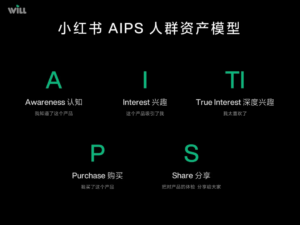

6. Evolving Marketing Nodes: Deepening Brand Connections

Brands are moving beyond one-off holiday campaigns to create long-lasting engagement strategies. This includes:

- Deepening Brand-Specific Nodes: Brands are amplifying key themes and emotions throughout the year rather than limiting marketing efforts to a single event.

- Creating Brand-Specific “Content Festivals”: Instead of relying solely on traditional holidays, some brands are establishing their own content-driven “festivals” to maintain audience engagement year-round.

Actionable Tip: Develop a long-term content strategy that integrates storytelling with emotional engagement. Whether through continuous themed campaigns or brand-created “content festivals,” sustaining engagement beyond seasonal peaks can create stronger brand loyalty.

Final Thoughts

As consumer expectations shift, successful brands in 2025 will be those that adapt to these emerging trends while maintaining authenticity. From seasonal marketing to emotional storytelling, these strategies can help brands foster deeper, more meaningful connections with their audience.

Want to elevate your seasonal marketing strategy and make a lasting impact? Our team is here to help. Contact us todayto explore how we can tailor innovative marketing campaigns for your brand.