As social commerce reshapes the digital landscape, one platform stands out for seamlessly blending content creation with e-commerce: RedNote (also known as Xiaohongshu).

For creators, influencers, and businesses eyeing the Asian market or global trends, the burning question is: Can you make money on RedNote, and if so, how?.

The answer is yes, but it requires strategy. From brand collaborations to opening your own shop, RedNote offers various monetization opportunities for those who know how to navigate its ecosystem. This guide explores the platform’s monetization models, requirements, and best practices to help you maximize your earnings.

What is RedNote and How Does Its Ecosystem Work?

To understand how to earn, you must first understand the platform. RedNote is a social commerce and content-sharing platform that operates differently from its Western counterparts.

Unlike TikTok or Instagram, which focus heavily on entertainment, RedNote is utility-driven. Its ecosystem integrates user-generated content (UGC) directly with e-commerce, making it a powerful tool for product discovery.

The user base itself is a major draw for advertisers. RedNote attracts a highly coveted demographic of young, affluent, urban dwellers who rely on the app to make purchasing decisions. This integration of user-generated content (UGC) directly with e-commerce reduces the friction between seeing a product and buying it, creating a fertile ground for monetization.

Core Features That Support Monetization

Several key features inherent to the platform facilitate earning.

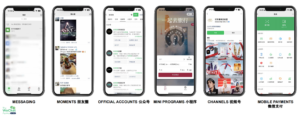

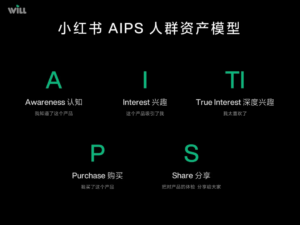

First and foremost is the search-centric discovery model, which allows long-tail content to remain discoverable for months, unlike the fleeting nature of viral feeds. Additionally, the platform integrates a built-in e-commerce shop functionality, allowing users to purchase items without ever leaving the app. Coupled with specific tools designed to smooth out brand collaborations and the “seed planting” mechanism that drives high engagement, the infrastructure is specifically designed to support creators who drive value.

Can You Make Money on RedNote?

Yes, absolutely. Both individual creators and brands can earn significant income on RedNote.

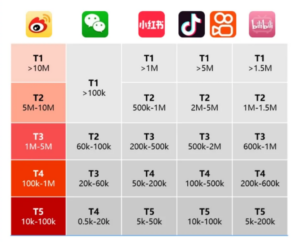

The platform supports a diverse range of earning methods, including ad revenue, brand deals, e-commerce, affiliate marketing, and premium content. Importantly, monetization isn’t reserved for mega-celebrities; both large influencers and micro-creators can monetize their specific niches effectively.

Does RedNote Pay Creators Directly?

RedNote does offer some direct monetization avenues, though they come with strict criteria.

The platform has introduced programs that allow creators to share in ad revenue or receive rewards based on engagement metrics. However, joining these official creator monetization programs typically requires meeting specific benchmarks regarding follower counts and content quality. It is also important to note that non-Chinese or overseas creators may face limitations regarding these direct payment setups compared to domestic users.

Can You Get Paid on RedNote via Indirect Methods?

For many users, especially those operating internationally, indirect revenue streams are often more accessible and lucrative.

Brand sponsorships remain a primary income source, where creators collaborate with companies through official tools or direct outreach. Affiliate marketing is another powerful method, allowing users to earn commissions by promoting products via tracked links. Additionally, creators can sell personal products or services directly through their own RedNote shop, or receive financial support from their community through virtual gifts and fan donations during live streams.

Monetization Models and Requirements on RedNote

To start earning, you need to navigate the specific models available.

Brand Collaborations and Sponsored Posts

Brand partnerships remain the bread and butter for many creators on RedNote. Brands actively search for authentic voices to promote their products, often utilizing platform tools, Multi-Channel Networks (MCNs), or direct outreach to find the right fit. These collaborations can take many forms, ranging from simple product placements to in-depth reviews and unboxing videos. The payment structure varies depending on your influence; micro-influencers might start with product exchanges, while established accounts can command flat fees or commission-based payments. To maintain credibility, it is crucial to follow best practices regarding negotiation and clear disclosure of sponsored content.

Affiliate Marketing and Product Promotion

If you prefer performance-based income, affiliate marketing is a highly effective tool. Creators can join affiliate programs either through RedNote’s internal systems or via external platforms. The process is straightforward: you earn commissions by promoting products using specific tracking links, with rates varying by product category. This model rewards creators who can drive actual sales, making it ideal for those who produce high-utility content like tutorials, detailed reviews, or live streams that demonstrate a product’s value. Success here largely depends on selecting products that genuinely resonate with your specific audience

Selling Your Own Products or Services

For those looking to build a standalone business, RedNote allows creators to open their own shops directly within the app. While this requires passing a verification process and adhering to platform fee structures, it unlocks significant potential. The platform supports this ecosystem with robust logistics solutions, such as RED Express and RED Box, which handle shipping and payment processing. This infrastructure makes it feasible for creators to engage in dropshipping, white-labeling, or launching their own personal brands without needing to build a separate e-commerce website.

Premium Content and Direct Fan Monetization

Beyond selling physical goods, you can monetize your relationship with your audience. RedNote offers features for premium content, allowing creators to charge for exclusive access or subscription-based material. Additionally, during live streams, fans can send virtual gifts and ‘super likes’ as a token of appreciation. These micro-transactions can add up to a significant income stream for creators with highly engaged fanbases, provided they meet the age and regional eligibility requirements.

MCN (Multi-Channel Network) Agency Partnerships

Multi-Channel Networks (MCNs) act as intermediaries that can help creators scale their operations. These agencies play a vital role in connecting creators with larger brands and campaigns that might be difficult to access individually. Partnerships often involve specific agreements, such as payment-per-video models or cross-promotion deals. However, creators must exercise caution and select legitimate MCNs to avoid scams or unfavorable contracts.

Best Practices to Maximize Your Income on RedNote

Creating High-Quality, Engaging Content

Success on RedNote requires a strategic approach to content creation. Because the platform is visually demanding, adopting a “visual-first” mindset is essential. This means leveraging high-quality photo and video editing tools to ensure your posts meet the platform’s aesthetic standards. However, visuals alone are not enough; you need storytelling that resonates with your target demographic. Consistency in both posting schedule and brand voice helps build the recognition necessary for long-term growth.

Building and Engaging Your Audience

Building a loyal audience is just as important as the content itself. This is often achieved by dominating a specific niche rather than trying to appeal to everyone. Active engagement is key—replying to comments, hosting Q&As, and fostering a sense of community signal to the algorithm that your content is valuable. Furthermore, tailoring your content based on audience preferences and encouraging user participation (likes, saves, shares) will help expand your reach.

Optimizing Monetization Strategies Over Time

As your account grows, you should adapt your strategies to maximize revenue. This involves tracking key metrics like post performance, conversion rates, and fan demographics to understand what drives income. Treat your account like a business by continuously testing new monetization features and revenue streams. Collaborating with other creators for cross-promotion can also introduce your profile to new potential followers and customers.

Challenges, Risks, and Compliance for RedNote Creators

While the opportunities are vast, monetization on RedNote comes with strict governance. The platform enforces rigorous rules regarding external links and directing traffic away from the app. Violating these guidelines can result in severe penalties, including shadowbanning or even account suspension. Creators must also navigate potential logistical hurdles, such as payment processing delays, complex commission structures, and regional limitations on certain features.

Common Pitfalls and How to Avoid Them

To protect your income, you must stay compliant. Always review and follow RedNote’s latest community guidelines to avoid inadvertent violations. It is also critical to verify the legitimacy of potential brand partners or MCNs before signing any agreements. Finally, maintain transparency with your followers regarding sponsorships; trust is your most valuable asset, and losing it can be fatal to your monetization efforts.

FAQ: Making Money on RedNote

Can you make money on RedNote as a beginner?

Yes, beginners can earn through affiliate marketing or product exchange sponsorships, even with a smaller following, provided their engagement is high.

Does RedNote pay creators directly, and how?

RedNote has creator programs that pay based on engagement and ad revenue sharing, but requirements are strict.

What are the eligibility requirements for monetization?

Requirements vary by method but typically include a minimum follower count, account verification, and adherence to content quality standards.

Is RedNote monetization available internationally?

Yes, but international users may face more restrictions regarding direct payouts and shop setup compared to domestic Chinese users.

How much can you realistically earn on RedNote?

Earnings vary widely based on niche, follower count, and monetization method, ranging from free products to significant monthly income for top influencers.

What are the best niches for monetization on RedNote?

Beauty, fashion, travel, education, and lifestyle are consistently the top-performing niches for monetization.