With China’s outbound travel sector rapidly rebounding, affluent Chinese female travelers are emerging as a key consumer segment. These high-spending tourists prioritize premium experiences, luxury accommodations, and unique cultural activities. For brands looking to attract this audience, Xiaohongshu (REDNOTE) has become an essential marketing platform.

Why Xiaohongshu Matters for Affluent Chinese Travelers

Xiaohongshu is a hybrid between a social media platform and an e-commerce site, where users share travel experiences, lifestyle tips, and product recommendations. With over 70% of its users being female, Xiaohongshu is the go-to platform for affluent Chinese women planning their international trips.

Consumer Profile: Who Are Affluent Chinese Female Travelers?

- Age Group: Typically between 25-45 years old

- Income Level: High-income professionals, entrepreneurs, and luxury shoppers

- Travel Style: Preference for luxury hotels, private tours, and high-end shopping

- Decision-Making: Rely on user-generated content (UGC), influencer reviews, and community recommendations

Top Travel Trends Among Wealthy Chinese Female Tourists

- Luxury & Boutique Hotels – They prefer unique, high-end accommodations over mainstream options.

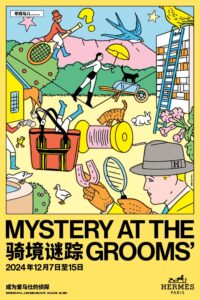

- Wellness & Adventure Travel – Activities like skiing, spa retreats, and cultural immersion experiences are in demand.

- Shopping Tourism – Designer boutiques, tax-free shopping, and VIP experiences attract these travelers.

- Food & Wine Experiences – Michelin-starred dining and exclusive wine-tasting tours are highly valued.

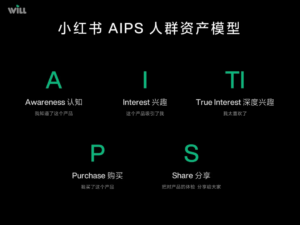

Marketing Strategies for Xiaohongshu

1. Partner with Travel & Luxury KOLs

- Work with travel influencers who specialize in high-end experiences.

- Ensure the content feels authentic and experience-driven.

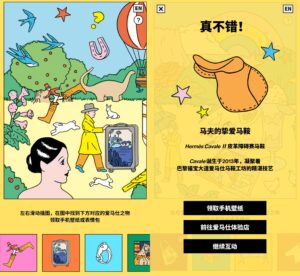

2. Leverage UGC and Community Reviews

- Encourage satisfied travelers to share posts and reviews.

- Utilize branded hashtags and challenges to boost engagement.

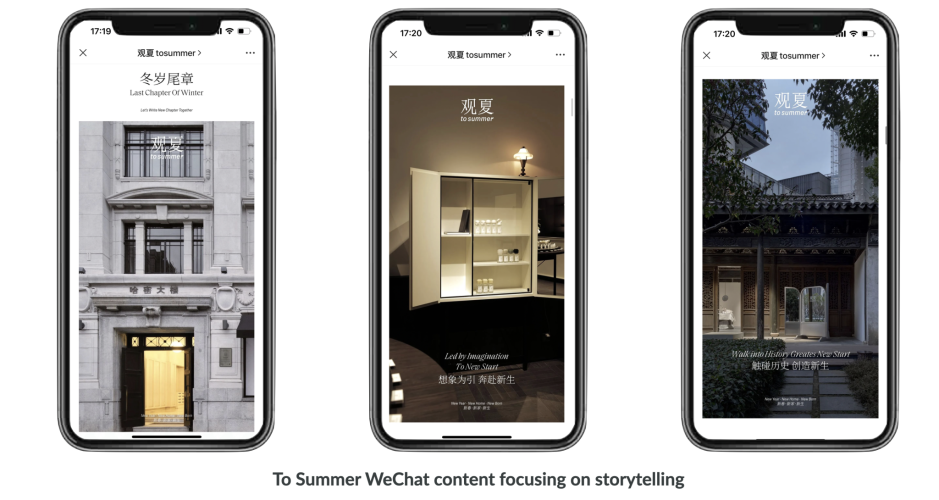

3. Optimize Content for Search & Discovery

- Use trending keywords like “luxury travel,” “boutique hotel,” and “exclusive experience.”

- Ensure posts include high-quality visuals, engaging storytelling, and actionable travel tips.

4. Run Targeted Xiaohongshu Ads

- Utilize precise audience targeting to reach high-net-worth individuals.

- Focus on interest-based placements related to travel, luxury, and lifestyle.

If you’re looking to attract high-spending Chinese travelers and maximize your brand’s impact on Xiaohongshu, we can help! Our team specializes in Chinese digital marketing, content creation, influencer collaborations and media buying to help you connect with the right audience.