As TikTok faces potential shutdown in the U.S. on January 19 due to ownership concerns, many “TikTok refugees” are seeking alternative platforms, and a new Chinese app is making waves in the American market. Xiaohongshu, known as RedNote in English, has skyrocketed to the No. 1 spot for free apps on the U.S. App Store, also claiming the top position in the Social Networking category for iPhone apps. This surge reflects a growing interest in the platform, as TikTok creators encourage their followers to explore alternatives in the wake of uncertainty.

Why Is Xiaohongshu Gaining Momentum?

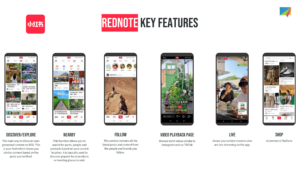

Xiaohongshu, originally launched in 2013, has evolved into a robust platform that resonates with creators and users alike. Often referred to as China’s answer to Instagram, the app combines the aesthetics of Pinterest with social shopping features, making it a compelling alternative for those seeking a new digital home.

Here are some key factors driving Xiaohongshu’s rise:

- A Creator-Friendly Layout: With a design reminiscent of Pinterest, Xiaohongshu offers creators an intuitive and visually appealing interface to share content.

- Social Shopping Features: The platform integrates e-commerce capabilities, allowing users to discover and shop products directly, enhancing the creator monetization potential.

- Viral Growth: During the COVID-19 pandemic, Xiaohongshu’s popularity surged among younger Chinese users. Today, it boasts 300 million monthly active users, with 79% of them being women.

Xiaohongshu by the Numbers

- User Base: 300 million monthly active users.

- Funding: The app has raised $917 million in venture funding from major investors like Tencent, Alibaba, ZhenFund, and DST.

- Valuation: Reportedly valued at $17 billion following a 2024 secondary share sale.

- Projected Profits: Expected to exceed $1 billion in 2024, signaling its robust growth trajectory.

Opportunities for Creators

Xiaohongshu’s growth presents exciting opportunities for creators:

- Content Diversification: The app’s unique mix of social networking and shopping enables creators to explore new types of content and revenue streams.

- Early Adoption Advantage: With its growing popularity in the U.S., early adopters can carve out a niche before the market becomes saturated.

- Supportive Ecosystem: Backed by substantial funding and a focus on e-commerce, Xiaohongshu is positioned to provide tools and features that empower creators to thrive.

Challenges and Considerations

While Xiaohongshu’s rise is notable, its long-term sustainability in the U.S. remains uncertain:

- Regulatory Scrutiny: As a Chinese app operating in the U.S., Xiaohongshu could face increased scrutiny from authorities.

- Competition: The app will need to differentiate itself further from established platforms like Instagram and Pinterest.

- Cultural Adaptation: To succeed in the U.S., Xiaohongshu must adapt its offerings to align with local user preferences and behaviors.

What’s Next for Xiaohongshu?

With its viral momentum and robust features, Xiaohongshu has the potential to disrupt the U.S. social networking landscape. However, its future will depend on how well it navigates regulatory challenges and adapts to the preferences of an American audience.

If you’re interested in leveraging Xiaohongshu for your brand’s growth, contact us today to explore tailored strategies that align with your goals!