1. Shanghai takes the lead as Chinese coffee consumption averages 16 cups per year

- China’s coffee industry amassed a staggering 265.4 billion RMB (approx. 36.66 billion USD) in scale last year, with an average per capita annual consumption of 16.74 cups

- Coffee Carnival is running in Shanghai between 30 April to 4 May, alongside over 50 esteemed local coffee shops.

- Additionally, takeaway, payment, and social media platforms initiated the “Drinking in the City” campaign in Shanghai, poised to invest nearly 100 million RMB (approx. 13.8 million USD) into the consumer market.

- With a net increase of 118 shops, marking a 14% year-on-year rise, the total count of Starbucks outlets soared to 7,093.

2.What’s driving China’s unstoppable second hand luxury market?

- China’s secondhand luxury market is tipped to grow to $30 billion (217 billion RMB) in 2025 from $8 billion (58 billion RMB) in 2020, with Gen Z and millennials (under 40) together accounting for more than 80 percent of the total number of secondhand luxury consumers

- From a luxury brand point of view, perceived value on the secondhand market can have direct repercussions on reputation and desirability in the eyes of consumers.

- Brands should not see the secondhand market as an adverse phenomenon, but encourage customers to trade in or resell their pre-owned items through authorized channels, ensuring that the brand retains control over the quality and authenticity of the products in the secondary market.

- Luxury brands must monitor and manage their perceived value in the secondhand market, as it can impact their reputation and desirability among consumers. Digital marketing efforts should focus on maintaining brand authenticity and highlighting the enduring quality and heritage of their products.

LINK:https://jingdaily.com/posts/what-s-driving-china-s-unstoppable-secondhand-luxury-market#8548723daa5e

3. Decoding China’s $170 billion ‘romance economy’

- China commemorates love on three separate holidays: the Western Valentine’s Day on February 14, the uniquely Chinese 520 Day on May 20, a celebration derived from internet slang where the numbers “520” phonetically resemble the words for “I love you” in Mandarin, and the traditional Qixi Festival, which usually falls in August.

- China’s Gen Z consumers are a key element of the “romance economy,” responsible for 54% of related orders according to the “Romantic Economic Big Data Report” released in 2022.

- Survey data from iiMedia Research in 2023 revealed that regardless of their relationship status – single, in a relationship, or married – over 90% of participants were eager to celebrate romantic festivals by presenting gifts to family and friends.

- Notably, jewellery ranks as the number top gift category for coupled-up individuals on China’s romantic days.

- Traditional gifts like flowers, personal care items, and beauty products remain favorites and “gift boxes” persist as a preference for consumers on seasonal occasions.

- “Love-brain” (恋爱脑) has recently emerged as a trending term online. It centers on the idea that individuals often lose their emotional or financial rationality when in love. This phenomenon prompted the creation of the phrase “scolding to cure love brain” (骂醒恋爱脑) as a response. And in turn, this has sparked a new type of service.

LINK: https://jingdaily.com/posts/decoding-s-china-s-usd170-billion-romance-economy

4. Xiaohongshu: Unlock new opportunities in Chinese beauty market

Customers are getting more connected to Chinese culture and caring about value, which makes domestic beauty brands more popular. Younger consumers are stepping up as key players in the domestic beauty market.

- Emergence of quality Chinese cosmetics: Domestic beauty annual sales surged around 10%, outperforming foreign cosmetics with a commanding market share of 50%.

- Co-create content with the brands: Hundreds of celebrities and top KOLs embarked on the offline and online collaboration with a lot of brands.

- Create a personalized IP Matrix: Xiaohongshu collaborated with more influential media like CCTV network and created more personalized IP/topics for brands.

LINK: https://mp.weixin.qq.com/s/4oAwT-Q0mtbWHGQtRYSPLg

5.ByteDance surprises AI rivals with ultra-low cost Doubao model:

- ByteDance has surprised the artificial intelligence industry with the ultra-low cost of its Doubao model

- The company said it is capable of processing 2 million Chinese characters, equivalent to 1.25 million tokens, for RMB 1 ($0.14).

- OpenAI’s most advanced multimodal model, GPT-4o, also unveiled this week, comes in at $5 per million input tokens handled.

LINK:https://technode.com/2024/05/16/bytedance-surprises-ai-rivals-with-ultra-low-cost-doubao-model/

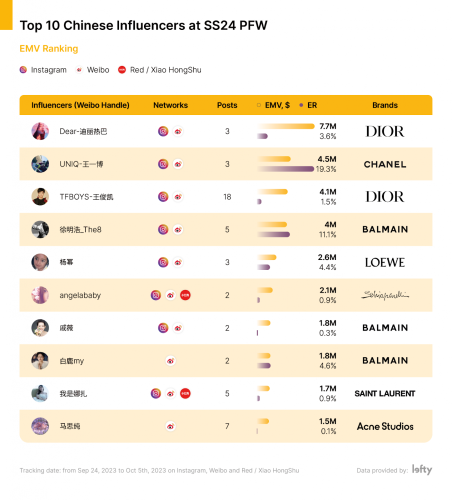

6. Which fashion campaigns for China’s 520 Day hit the mark?

- Luxury fashion campaigns for China’s 520 Day focus on limited edition collections, celebrity endorsements, and creative storytelling, often in the form of mini videos.

- Brands like Gucci and Saint Laurent tapped into Gen Z’s preferences by incorporating traditional Chinese elements and leveraging digital platforms for greater engagement.

- 520 Day’s fusion of traditional Chinese culture with commercialism highlights the evolving landscape of celebrations and consumer behavior, emphasizing the importance of cultural resonance and meaningful experiences in luxury marketing strategies for brands looking to better connect with consumers.

- These strategies aimed to blend cultural significance with contemporary marketing, enhance brand appeal and foster emotional connections with consumers.

LINK: https://jingdaily.com/posts/which-fashion-campaigns-for-china-s-520-day-hit-the-mark

7. 2024 May Day Holiday: The rise of small cities tourism and AI companions

- Amid an economy yet to fully recover to pre-pandemic levels, this year’s May Day break underscores a notable trend towards tourism in lesser-known destinations.

- On social media platforms like Xiaohongshu (RED), many young people are keen to explore counties and even aim to ‘visit Top 100 Counties of China’ as a novel approach to May Day travel.

- Hong Kong has shifted its focus to cultural and artistic events, as well as large-scale concerts.

- It is also worth mentioning Japan. With the Yen reaching a 34-year low against the US dollar during the holiday period, this made it more attractive for overseas tourists.

- ‘AI companion’ emerged as a new trend in travel. This involves using AI technology to offer personalised travel assistance services, crafting tailored itineraries and services.