China’s marketing strategy is a minefield. If you want to build a brand in the Chinese market, you need to know how to navigate it.

Entering the Chinese market is not only intimidating for the newcomers but also for existing businesses. Rapidly changing tastes, the market’s vastness, and nuanced preferences of more than 1.4 billion consumers living in very differentiated geographic and socio-cultural environments can be daunting for well-established players as well.

This is especially true for FMCG that are hyper-sensitive to consumers’ evolving tastes. That’s why often there is no such thing as a one-size-fits-all marketing strategy in China. Actually having one monolith strategy for China can be more harmful than having no strategy at all.

Brands must develop strategies for localized branding, communication, e-commerce, and traditional distribution in order to build a good business in China. These will necessitate a thorough awareness of consumer patterns and profiles, as well as familiarity with local marketing and operations. Otherwise, they will be unable to respond effectively to consumer desires and needs, increasing the danger of failing.

Why Is It Necessary to Localize?

The main point is that it’s easy for brands to assume that Chinese consumers are one homogeneous group of people with identical tastes and preferences. Also, most brands tend to focus on consumers based in China’s 1st tier cities like Shanghai or Beijing.

The Chinese city tier system is an unofficial hierarchical classification of Chinese cities. Media often use it as a point of reference to illustrate their financial, commercial, and overall business attractiveness. Usually, there are 5 levels of so-called tiers with some outlets adding an additional classification for the most rapidly developing cities. These are called New Tier 1 cities with Chengdu, Chongqing, Hangzhou, Wuhan, Nanjing, and Tianjin among them. Only imagine that there are almost 150 cities in China that are bigger than Berlin (3.5 million).

Every target audience has diverse needs and aspirations, and firms that don’t have a defined marketing plan will waste company resources chasing the incorrect demographics.

It’s a big misconception that consumers in those 2nd or 3rd-tier cities are the same as consumers in Shanghai or Beijing. A lot of reports on Chinese consumers often focus on the population samples from the biggest cities leaving the intricacies and local differences out of sight. People living in different Chinese provinces and locations will show different consumer behaviors and have varied income levels. Very often even the climate or weather patterns can play a big factor in their consumption habits.

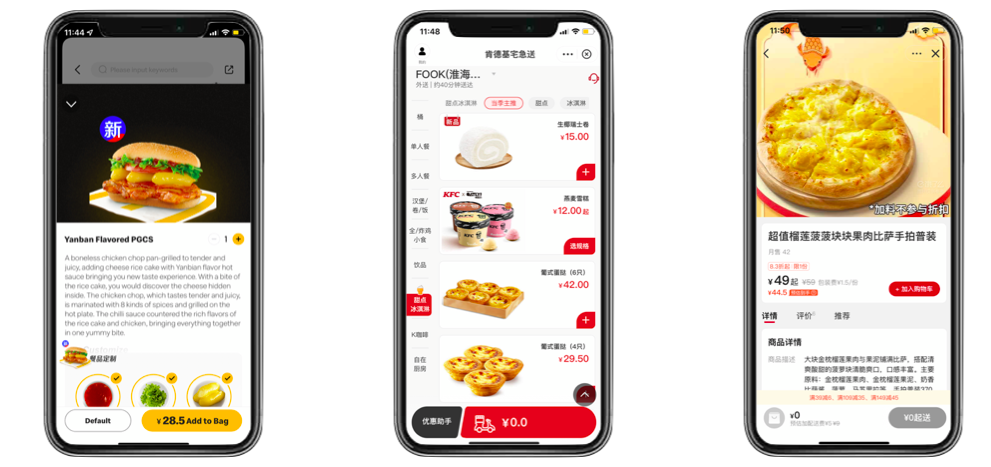

Examples of global fast-food chains adapting to local tastes: Mcdonalds’ pickle sandwich, KFC’s egg tarts, and durian pizza from Pizza Hut

Local Nuances

Just to give you an example, and of course, these are just exaggerations. E.g. Chengdu youth scene is famous for being among the most flourishing in China while people from Wuxi, an over 6 million people city near Shanghai, are renowned for their entrepreneurship spirit. Based on deeper research and local knowledge you can find a lot of nuances and specific interests that you can leverage in your brand communication, packaging, and pricing that will ultimately make a difference.

So when you’re trying to figure out how to make your retail experience more Chinese-friendly, the first step is figuring out who exactly you’re trying to attract—and then how best to reach them. Some brands might find success by hiring local employees who speak the dialects of their target market(s) fluently. They can often offer their own personal recommendations; others might do better by partnering with influencers who already have strong followings among those groups of people. Surveys and local focus groups can also be of great help.

Competitors in the biggest Chinese cities are fierce and the market is well saturated with all kinds of goods readily available. Therefore brands now want to expand their reach and deepen their penetration of the Chinese market. Because of a lack of understanding and applying the same strategies that worked in the biggest Chinese coastal cities, foreign brands often fail and are reluctant to continue their expansion which doesn’t need to be the case.

How to Localize – Things to Consider

Because of the local differences, you might rethink:

- Brand message – is there some other unique selling point that could be more appealing to the local target audience?

- Packaging – is the design and size suitable for local needs? Maybe the locals prefer smaller packages to have a try of the product?

- Ingredients – can you add some local ingredients to make your product more appealing to the local palates?

- Necessity – is your product adapted or even needed in the targeted location? Promoting stylish rain boots makes sense during the Shanghai rain season. However not so in Beijing where summers are usually hot and dry.

- Pricing – is the price too low or too high?

- And more to consider.

Strategy for China – Conclusions

Each country, market, demography, and way of life are distinct; it is the marketer’s responsibility to customize messaging and techniques to these diverse local trends. By recognizing these patterns and the economic, social, and technical influences that influence the Chinese customers, brands in China can better prepare for the future and succeed in the present.

➡️Find out more about China’s core target consumer groups – Generation Z and Silver Generation.

If you wish to know more about marketing in China, please contact our team. We use our knowledge and expertise to help businesses build meaningful partnerships and develop their network among Chinese customers. For additional information, please contact at contact@thewechatagency.com.